What is GST? How it will affect?

Hello Guys I will explain what is GST and how will it impact business and the common man. To understand Goods and Services Tax first we need to understand how current taxes work in India currently. Will also cover What is CGST & SGST.

What are Taxes?

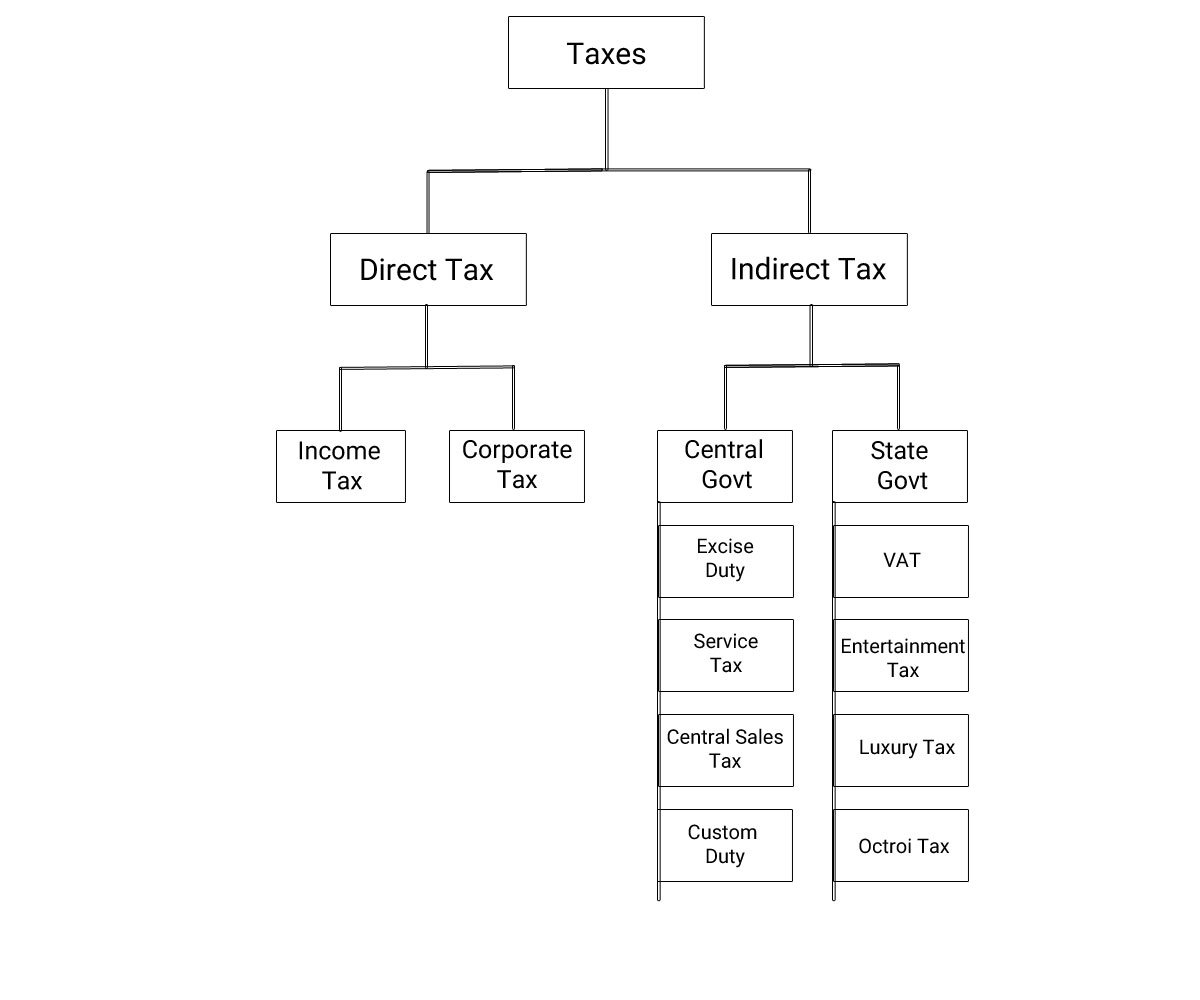

Taxes are the amount of money we pay to our government for government expenditure. It is a fee charged on product, services, income. Currently, we have two kinds of taxes Direct and Indirect tax.

Direct Tax is the tax that is imposed on a person, which is paid by the person directly to the government. For Eg: Income Tax, If the person is liable for income tax then he has to pay the tax directly to the government.

Indirect tax is imposed on products and services and is paid to the government via a third person. For Eg: Service tax, If you went to the restaurant and had something to eat, you pay service tax which is included in the bill to the owner of the restaurant. Then the restaurant owner pays service tax to the government, which is collected by the individuals like you. So this way you pay to government service tax via the third person.

What is the problem with the current tax system?

There are two important problems with the current arrangement.

First when the good is manufactured the central government levies central excise at the factory. Then when the good reaches the retail outlet and is bought by the consumer, the state government levies VAT (Value added tax). So we have to pay double tax which is called cascading effect (Tax over Tax). So, we have a tax at the factory which adds to the cost of the shirt and another tax on the final price.

Since states have their exclusive domain on consumption tax within their borders, they treat goods coming from other states as “imports.” For example, if a shirt maker in Maharashtra buys dye in Gujarat, he would have paid central excise and Gujarat’s state taxes on the product. At this cost, the Maharashtra government would levy its tax if the shirt is sold in the state. If the shirt is sent across Maharashtra’s border and sold in Andhra Pradesh, an “export” tax called central sales tax is collected by Maharashtra.

As the example suggests, India is politically one country, but economically it is fragmented. This kind of various taxes causes commerce across state borders expensive, complicated and a little unmanageable due to the numbers of taxes. This is why GST is going to help our economy.

What is GST?

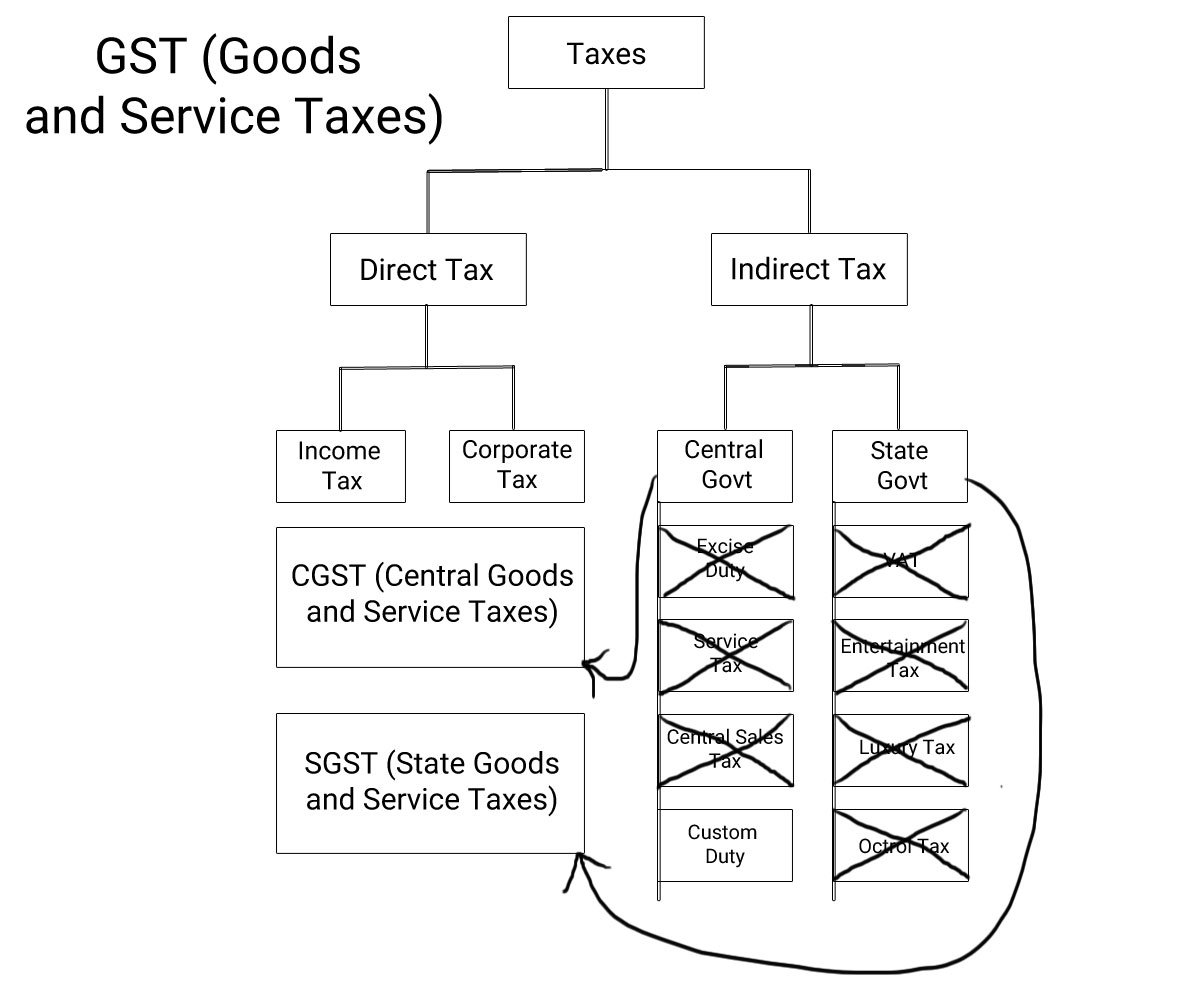

GST is an indirect tax and it will not impact the direct taxes. It is imposed on goods and services. GST will replace many central and state indirect taxes like Excise Duty, Service Tax, Central Sales tax, VAT, Entertainment Tax, Luxury Tax.

There are two taxes levied differently on central and state CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax). All Central Government applied taxes will be replaced by CGST except Custom Duty, and all State Government applied taxes will be replaced by SGST (State Goods and services tax).

Today we have no idea how much exactly we pay taxes on goods we purchase. If you buy the merchandise you pay VAT which is included on your bill, so you have you know how much VAT you paid on that merchandise. But the merchandise has already been taxed with central excise duty before reaching the retail outlet, but this tax is not mentioned on the bill so you don’t know the amount.

Therefore, today it is reasonable to assume we pay well over 20% tax for most merchandise we buy.

In GST, consumers benefits.

- All the taxes are collected at the time of consumption. For Eg: if a shirt is priced at 18% it will include both state and central government taxes.

- Once the barriers between states are removed, we as consumers will not have to pay “tax on tax”which is what happens when goods move across state borders.

- It will reduce Black Money, every transaction will be on paper as GST is a single tax from the manufacturer to the consumer. To see the previously paid tax everyone will insist invoice on a transaction which will eventually result in a paper trail, so income tax can track all the transaction.

- Seamless flow of good between states and across the nation.

- Ease of business, Businessman has to register for various tax authorities to do business and file various tax returns. But with GST only one tax return is filed which will encourage the businessman to do more work.

The government has recently disclosed the tax slabs in GST. Some food items have been exempted from this tax. Other slabs are 5% for commonly used goods, 12% and 18% are standard rates for GST and 28% is for luxury goods and services. For the full Tax, Slab Click here.

These are some item GST is not applicable on:

Alcohol, Tobacco, Electricity, Petroleum products

So GST is going to reduce the overall tax burden on consumers. Though you might see a difference, not at an early stage.

Watch this short video for quick explanation:

Courtesy : CA Gourav Jashnani Youtube channel