Converting Bitcoin to USD: Understanding the Tax Implications

If you are thinking about converting your Bitcoin to USD, it’s crucial to understand the tax implications that come with bitcoin conversion. While Bitcoin and other cryptocurrencies are not yet regulated in the same way as traditional currencies, they are still considered to be taxable assets by the IRS. If you’re looking to cash in your Bitcoin for USD, here are some things to consider.

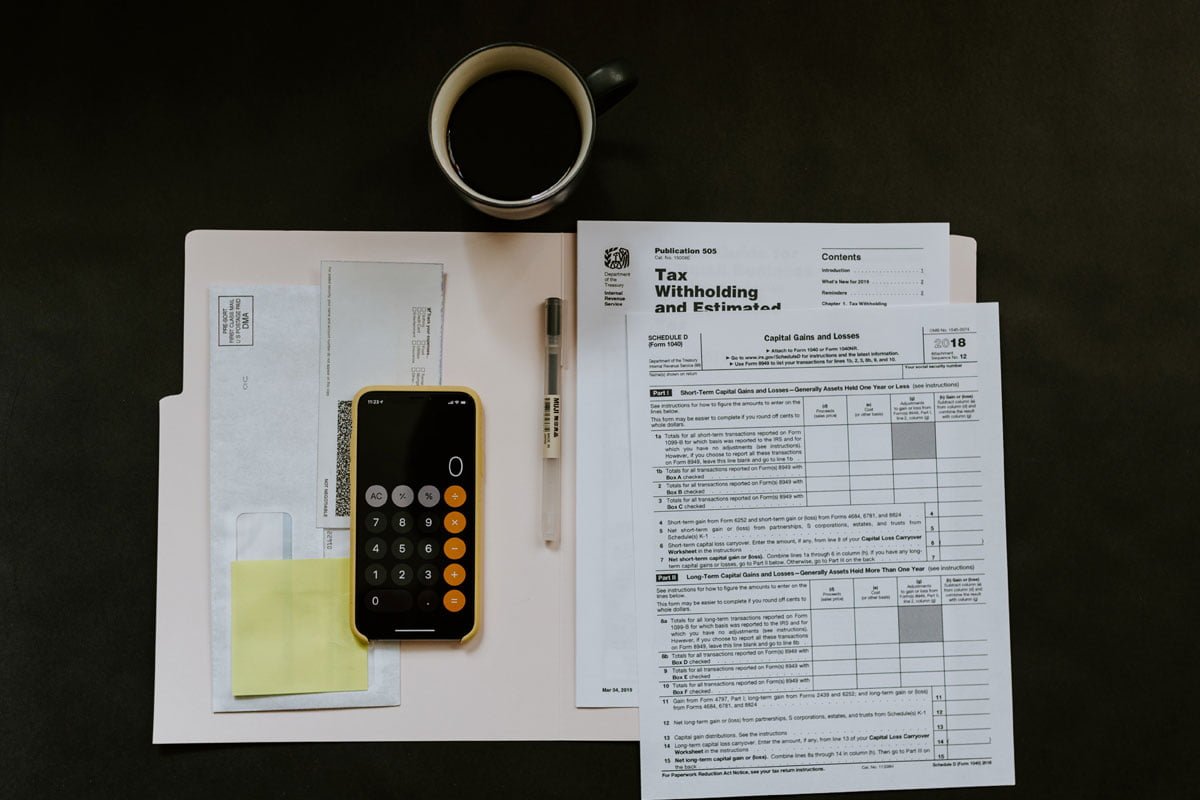

The Basics of Bitcoin Taxation

In the eyes of the IRS, Bitcoin and other cryptocurrencies are treated as property rather than currency. When you get cash in return for your crypto, it will be subject to capital gains tax in the same way as any other investment. Capital gains tax applies whenever you set an asset, such as Bitcoin, for a profit. How much tax you can expect to pay when converting Bitcoin to USD will depend on several factors, including how long you held the Bitcoin and your tax bracket.

Use a Bitcoin to USD converter to find out what your bitcoin holdings are currently worth.

Short- vs Long-Term Capital Gains

How much tax you will need to pay on your Bitcoin conversion will depend on whether you held the asset for less or more than a year. If it’s less than a year, you’ll pay short-term capital gains tax, which is taxed at your regular income tax rate ranging from 10% to 37% depending on how much you earn. On the other hand, long-term capital gains tax, which applies to assets that you have held for longer than a year, will be taxed at a lower rate ranging from 0% to 20% depending on your income.

Calculating Your Tax Liability

You will need to know the cost basis of your Bitcoin and the sale price to calculate your tax liability on your Bitcoin conversion. The cost basis refers to the original price you paid for the Bitcoin including any fees that you paid to purchase it. On the other hand, the sale price is the amount of USD you received from the sale of Bitcoin. The difference between these two will be your capital gain or loss.

Other Tax Considerations

Along with capital gains tax, there are some other tax considerations to make when it comes to Bitcoin and other cryptocurrencies. For example, if you receive Bitcoin as a payment for goods or services, the fair market value of the Bitcoin at the time you receive it is considered income and will be subject to income tax. The same applies if you mine Bitcoin.

Holding Bitcoin in Exchanges and Wallets

It’s also worth noting that if you hold Bitcoin in a foreign wallet or exchange, you may be subject to foreign tax laws. It’s crucial that you understand the tax laws in your home country along with those in any country where you hold Bitcoin.

Navigating the tax implications of Bitcoin conversion can be complex, particularly for newcomers or those with a large portfolio. Before you start, it’s a good idea to consult with a tax professional who specializes in cryptocurrency taxation.