Read Time:1 Minute, 3 Second

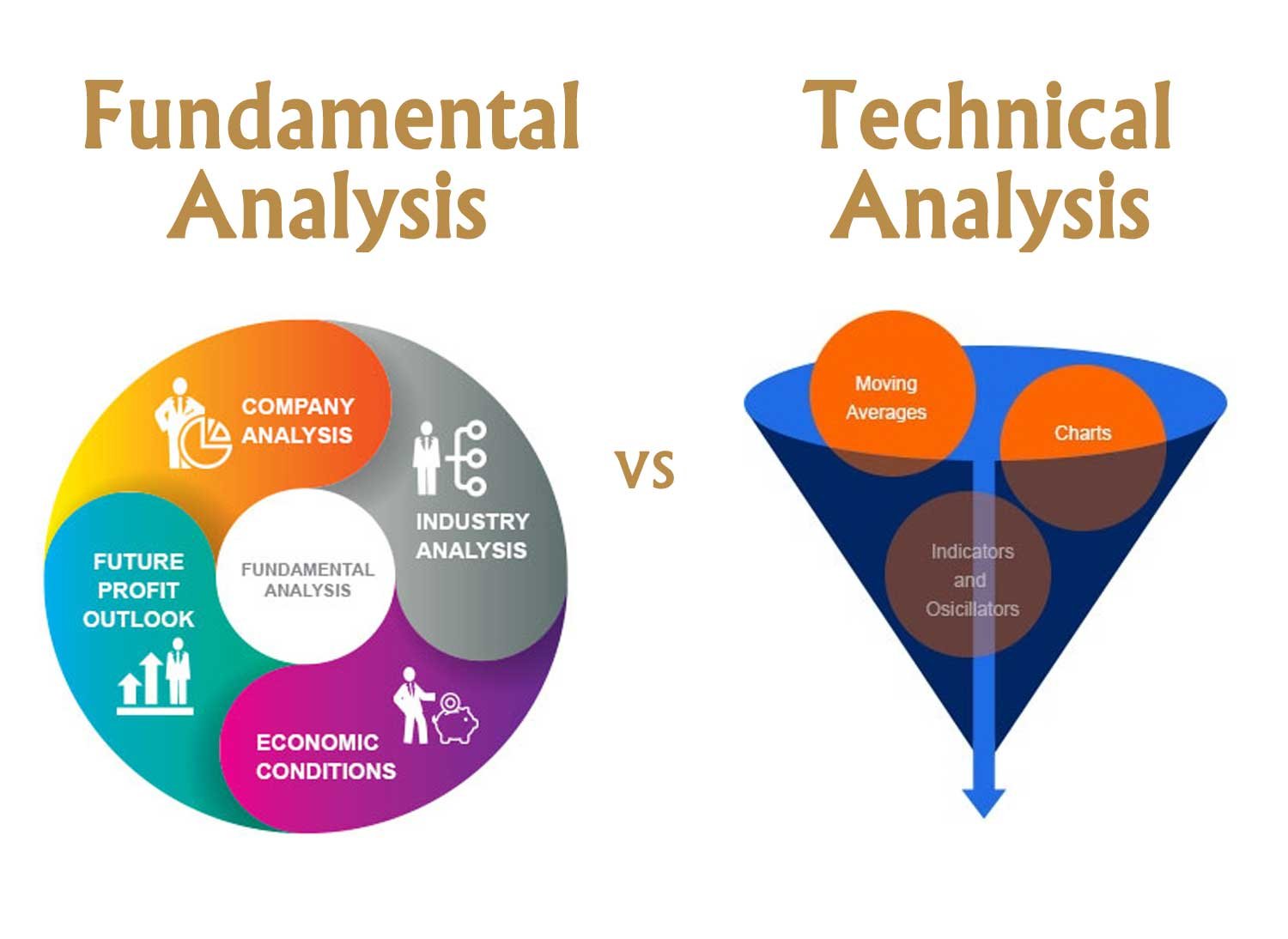

Fundamental analysis and Technical analysis are the two main ways when it comes to analyzing the financial markets. Fundamental analysis looks into economic and financial factors that influence business to predict the future of a stock. Technical analysis looks at the price movements of a stock to predict the future price of stock.

| Fundamental Analysis | Technical Analysis |

|---|---|

| Fundamental analysis is a method of evaluating the stocks by measuring the intrinsic value of a stock. | Technical analysis has the stock’s price and volume as the only inputs. |

| It studies overall economy, industry conditions, financial condition and management of companies. | It use stock charts to identify patterns and trends that suggest what a stock will do in the future. |

| Earnings, expenses, assets and liabilities, ROE, ROA, EPS, PE ratio are all important characteristics to fundamental analysts. | Tools used is simple moving average, MACD (Moving Average Convergence Divergence), Relative Strength Index, Parabolic SAR |

| Fundamental analysis is useful for long-term investment | Technical analysis is useful for short-term investment |

| It helps identify undervalued or overvalued shares. | It is useful in timing a buy or sell order. |

Here I have mentioned the basic difference in fundamental and technical analysis. Though both of these topic are vast and both have to be studied deeply for analysis.

One Reply to “Difference between Fundamental Analysis and Technical Analysis”