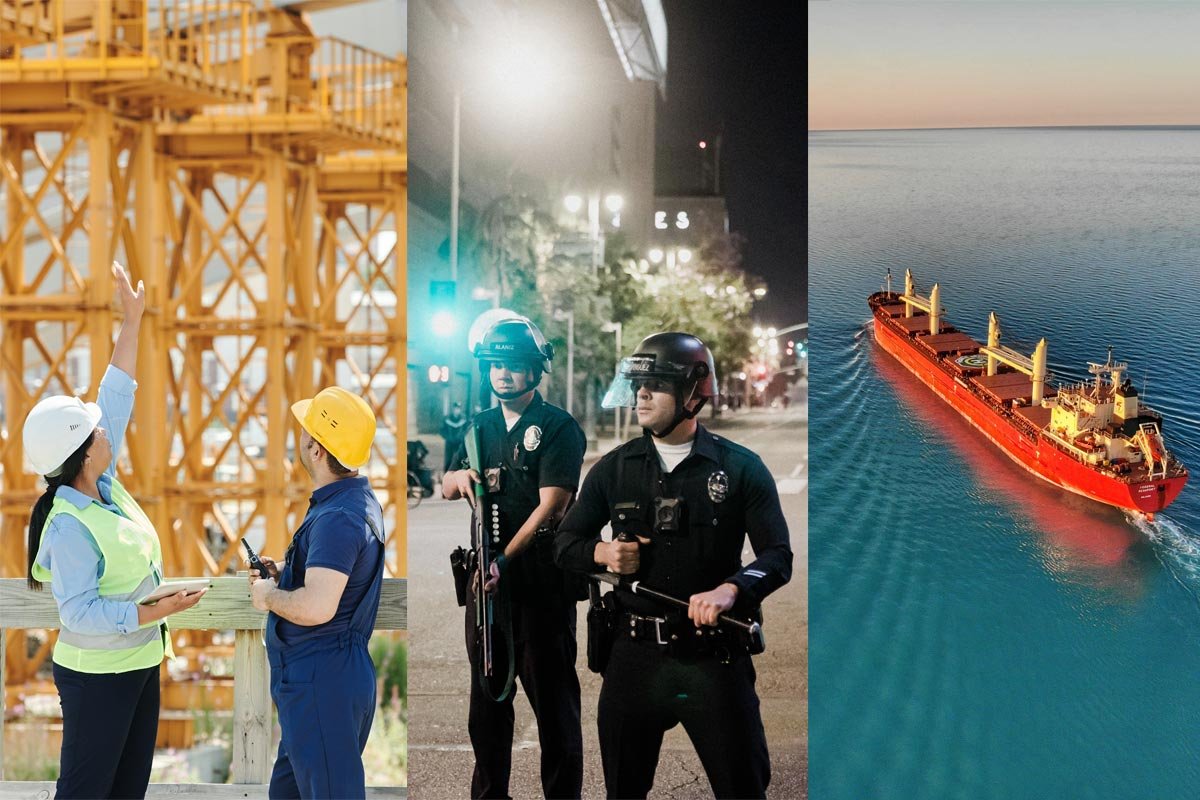

There are many different occupational paths that we can follow in life. Some people like to work in an office, while others prefer the gig economy. Then, there are those ambitious employees who take on high-risk jobs like construction, law enforcement, and mining and operations. There are many perks to taking a high-risk job, but it can be extremely physically, mentally, and financially taxing if you aren’t prepared.

The Allure of High-risk Jobs

If you’re looking into taking a high-risk job, there are many benefits over “regular” jobs that you are probably already acutely aware of. Typically, the higher risk means that you can earn more money. That is typically true because many people prefer to play it safe and take easier jobs. That is why oil rig workers and transmission tower climbers can earn close to $100,000 per year, depending on the employer.

Many people also choose to work high-risk jobs because of the thrill they receive every day. Often, completing a dangerous job means that you get a bigger reward and higher job satisfaction. For these types of thrill-seekers, it is about risk versus reward. The more challenging the task, the more fulfilling it is to do it every day.

Some people also take these jobs out of necessity. Either job opportunities may be few and far between where they live or they need money and have limited skills. Then, there are people who are destined to work high-risk jobs. They may have had the skills passed down from their parents, so they continue the business.

Whatever your reason may be for taking a high-risk job, it is important that you are safe and responsible.

How High-risk Jobs Can Affect Your Financial Planning

When you have a high-risk job, you need to be smart about your financial planning. In addition to ensuring that you can pay the bills, you also need to think about your family. This is especially true when you work dangerous jobs like those in construction, law enforcement, or steelwork. If there is a risk that you can die on the job, then planning is essential. Specifically, you need to plan for the financial stability of your loved ones.

With that in mind, it is wise to consider taking out a life insurance policy. However, before you do, you will need to do your research. Many insurance companies will ask for a higher rate because of the risk involved in your job. If this is the case, then you will need to budget accordingly. You could also try to reduce the rate by getting insurance through your job. Many people also pay their premiums annually to save some money.

You should also budget for the potential reality of getting injured on the job. It is not great to think about, but what if you get hurt and you can no longer work? There are workers’ compensation and other plans available. However, that may not be enough to ensure that your family can pay the bills. Start an emergency fund now and add to it every month. You have to be ready for any scenario.

Maintaining Your Physical Safety

It goes without saying that a high-risk job can be dangerous. The good news is that companies are required to set protective equipment requirements and conduct inspections. With that said, you also need to take responsibility for your own safety. If you feel unsafe at work, talk to your manager and ask how they can ensure your security. If they don’t have a good answer, reach out to higher-ups in the organization.

Many employers may also provide classes that teach you about physical safety. One example is the height safety compliance program. This is a program that teaches employees about the safety-related rules and regulations for jobs that revolve around heights. It also teaches specific safety tactics, like harness fit testing and correct tie-off techniques. Ask your employer if they offer programs for your specific line of work.

In the case that you are injured at work, it is important to use the resources at your disposal. In addition to the benefits offered by workers’ compensation, there are other programs that may be specific to your job. For instance, there is the Federal Employers’ Liability Act. This is a protection for railroad workers who sustain an injury at work. There is also the Longshore and Harbor Workers’ Compensation Act, which protects individuals harmed in maritime jobs. If you are hurt, reach out to the appropriate resource and get the help you need.

Mental Health Is Important Too

High-risk jobs can also be incredibly mentally draining, especially if you are constantly in harm’s way. If you are stressed and burned out at work, it can affect your performance. Many high-risk careers, like law enforcement, are also incredibly important to the common good of society. So, if you don’t perform to your highest ability, then you could cause harm to people other than yourself.

That is why it is important that you have a proper work/life balance. Make sure you are not being forced to work multiple overtime shifts in a row. Also, don’t try to work past your limits just to make more money on your paycheck. To avoid mental fatigue, start and leave work at the same time every day. Take overtime if you need it, but don’t make it an everyday thing.

If you think you aren’t getting the support you need at work, speak to your manager. They need to have an open-door policy, and you need to be comfortable enough to approach them. Describe exactly what you need to be happy in your work and perform to your best. If you get help but are still feeling drained, consider speaking to a therapist.

In the end, there are many perks to taking a high-risk job, but there are also some concerns. Think about the information described above and weigh the pros and cons. Then, make the best decision for you and your family.