The Impact of Bitcoin on Banking

Traditional banks are hesitant to adopt these digital assets like cryptocurrency, blockchain and bitcoin because they believe their inherent hazards outweigh their potential benefits, even though the cryptocurrency industry is booming and gaining popularity.

Recently, the OCC (Office of the Comptroller of the Currency) published a series of interpretive letters outlining how traditional financial institutions can engage in transactions utilizing digital currencies (or develop related services). This initiative corresponds with the OCC’s anticipation that further regulatory guidelines will assist banks in becoming more comfortable with digital assets.

Why do Banks View Cryptocurrencies with Caution?

At the beginning of January, the OCC declared that national banks and federal savings associations may now employ public blockchains and stablecoins for payment processing. It paves the way for banks to process payments significantly faster without requiring a third-party agency.

Distributed Nature

A cryptocurrency administered by a central bank decreases the asset’s initial attraction. Hence some banks do not feel they can enter this market successfully. In addition, it is believed that the decentralized nature of the currency undermines the authority of central banks, leading some to fear that they will no longer be necessary or unable to govern the money supply.

Volatility

In general, the price of cryptocurrencies (Bitcoin in particular) has been erratic throughout their brief existence. It is due to various factors, including market size, liquidity, and market participation.

How Can Financial Institutions Enter the Industry?

To avoid falling behind, banks must find a way to embrace new technology and view it as an ally, not an adversary. The use of cryptocurrencies could speed up, enhance, and modernize financial services. Several recent advances in the market can ease banks’ concerns about the risks and enable them to see the potential advantages.

The provision of custody services

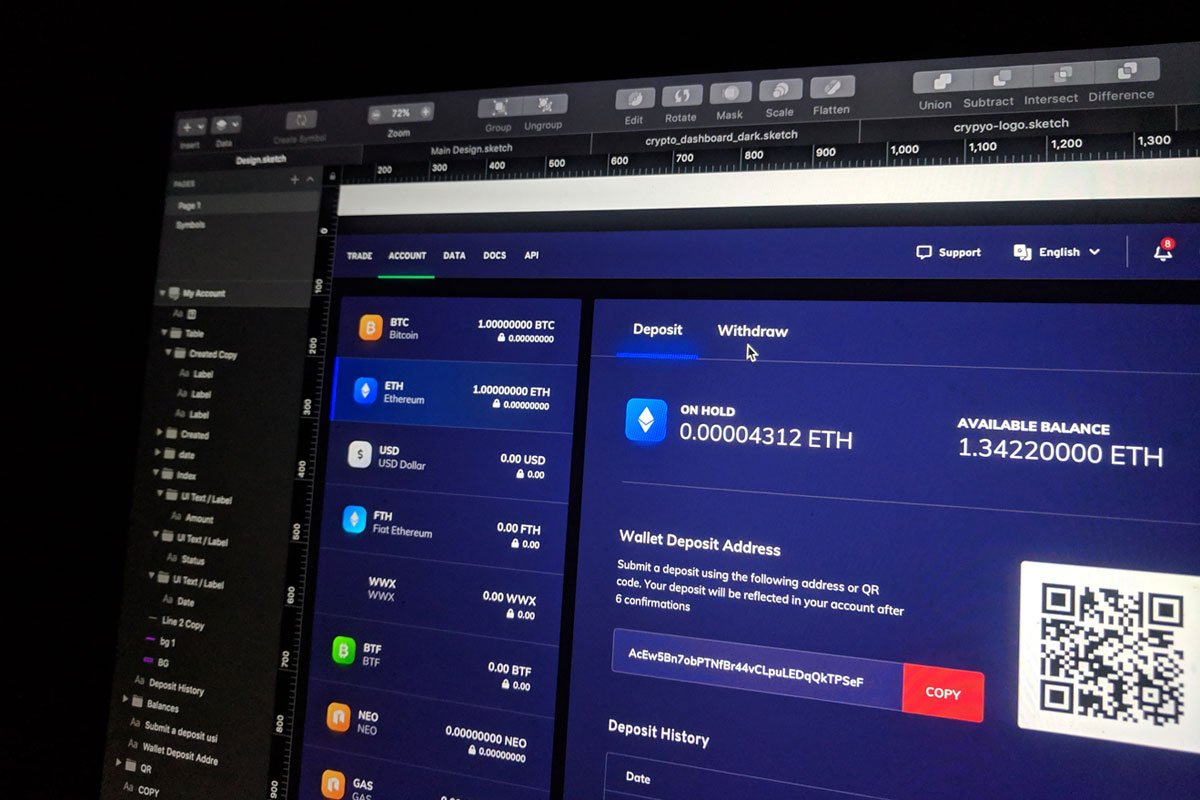

In July, the OCC announced that banks and credit unions could offer crypto custody services to their customers, including storing the unique cryptographic keys required to access private wallets.

Simple Onboarding & Skilled Assistance

By creating tools that enable the adoption of cryptocurrencies by their customers, banks might assist in bringing in new, less experienced individual investors. For instance, unskilled bitcoin investors may be unable to create a wallet to store their money.

Banks might offer cryptocurrency accounts that accrue interest, allowing users to invest the cryptocurrency in the future or through other financial instruments. So do your research on stronie internetowej before start investing in bitcoin.

AML/KYC Regulations Implemented

The Financial Crimes Enforcement Network (FinCEN) concluded in 2019 that all cryptocurrency transactions and custody services conducted by crypto firms deemed money service organizations must continue to comply with AML/KYC laws.

It will assist in preventing fraudulent transactions, criminal behaviour, and fraud on these sites. In addition, this legislation could assist banks and larger financial institutions in doing due diligence on consumers engaged in crypto transactions, thereby alleviating their concerns regarding the risks posed by these transactions.

Potentially, blockchain could facilitate a streamlined view of shared individual data between banks, loan officers, and other parties. This blockchain data might then be employed by all financial institutions, allowing for rapid assessments of consumers to discover any red flags indicating criminal conduct immediately.

Security Issues

Banks can alleviate bitcoin holders’ security fears. The compromise of private wallets and exchanges is a source of anxiety for many holders. Clients’ minds would be at ease if banks with a good reputation helped safeguard digital currency from theft or hacking. Bringing cryptocurrencies under bank supervision could minimize criminal activity and the idea among outsiders that cryptocurrency transactions are unsafe.

Market Trends

Here are a few examples of the industry’s recent embrace of digital currency: JP Morgan has accepted Coinbase and Gemini as new banking clients. Fidelity Digital Assets will establish a cryptocurrency fund. PayPal’s network now permits cryptocurrency transactions.

Conclusion

Few guidelines and regulations exist for digital assets like cryptocurrency, blockchain and bitcoin, which makes banks and financial institutions hesitant to accept them. Concerns over the security and stability of cryptocurrencies also discourage banks from entering this market; nevertheless, institutions should consider its potential benefits instead of focusing on the risks associated with this technology.

Therefore, we do not wish to discard these benefits due to the possibility of illicit conduct. Instead, we wish to provide compliance guidance to assist banks in innovating.”

Banks and Financial institutions should not be hesitant and view blockchain, bitcoin and cryptocurrency as rival partners. Instead, adopting cryptocurrencies and blockchain technology as a whole can expedite procedures and usher in the next generation of banking innovation and efficiency.