We all know the taxes on cars are quite high in today’s market, you have road tax, GST and more, but do you know the exact breakdown of the taxes? In this article, I will give you a detailed breakdown of how much you pay in taxes for your cars, with examples of your beloved cars. Let’s get started.

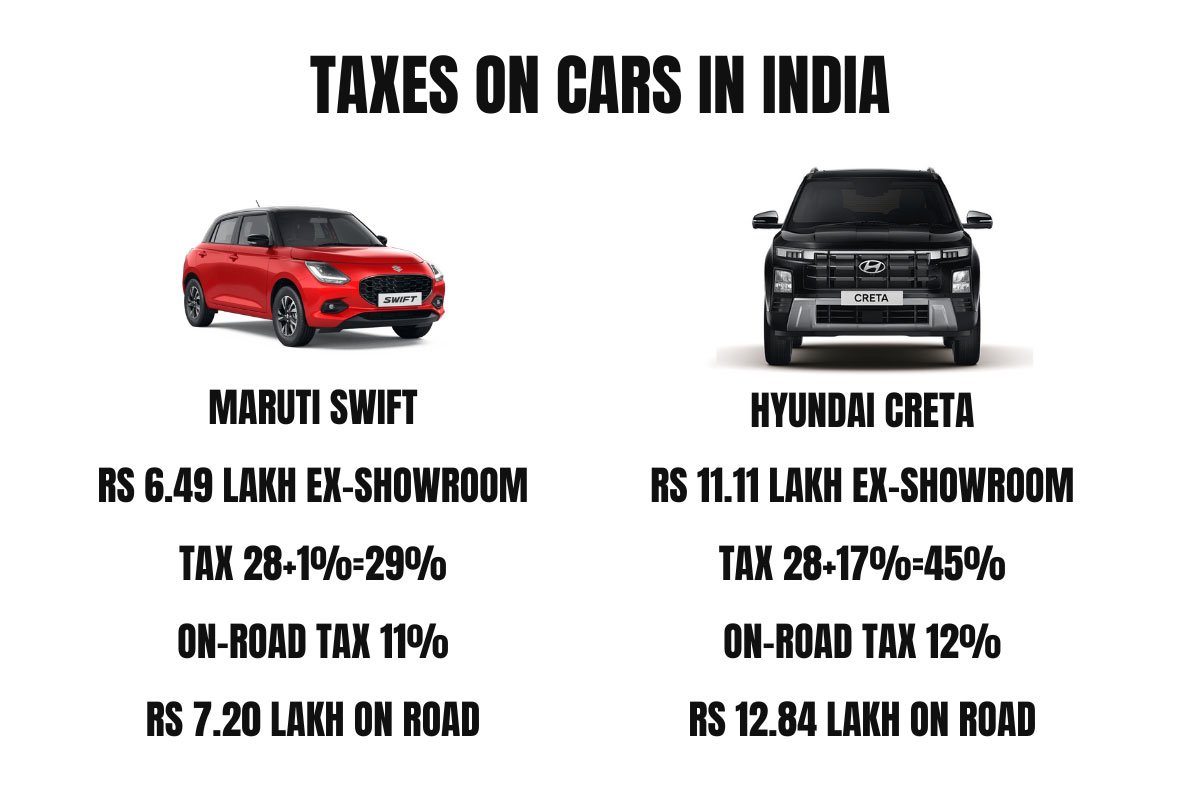

Let’s consider a couple of examples. First, let’s see the Base variant of a popular car Maruti Suzuki Swift.

First Example

The Ex-showroom Price of the Base Variant Swift is Rs 6.49 Lakh, which includes GST and Cess. Swift is a small car that has an engine of less than 1200cc and is less than 4 meters long. You can refer to the table below. This means Swift will attract a GST rate of 28% and a Cess of 1%, the total is 29%, which is included in the ex-showroom Price.

Rs 6.49 lakh*29% = Rs 1,88,210 Lakh, so your car costs only Rs 4,60,790, this is just the ex-showroom Price.

Now let’s add the On-road price, which Includes Registration, Road Tax, and Insurance

You can click here to see the Road Tax in Maharashtra. This tax varies from state to state. Just Google your state name with road tax, for example, “Maharashtra Road Tax for Cars“, you will get the list of taxes for your state

Registration and Road Tax for Swift is 11% on ex-showroom price Rs 6,49,000*11% = Rs 71,390

Now the Insurance cost varies on several factors, starting from the type of vehicle, age of the driver, location, gender and more, but for Maruti Suzuki Swift it can be anywhere around 20-30k.

So the total of the Maruti Suzuki Swift base model, which is produced at Rs 4,60,790, will cost you Rs 7,20,420 on road in Maharashtra; this price can still vary based on your location. In total, you are paying 36% of tax on the new Maruti Suzuki Swift.

Second Example

Now let’s take the famous Hyundai Creta as an example, I will consider the base model of Creta, which costs Rs.11,10,900. Creta attracts 28%, which is the same as Swift, but it is not a sub-4 meter car and has an engine of 1500cc, so the Cess is 17%, so the total tax is 45%.

So when you calculate 45% of Rs 11,10,900, it comes to Rs 4,99,905, which is included in your ex-showroom cost. So the actual cost of the car is Rs 6,10,995

Now let’s calculate the Road tax. The road tax for Creta petrol is 12% in Maharashtra, which is Rs 1,33,308

Now let’s calculate insurance, which again will vary, but for Creta it will be around Rs 40-45k

So the total is Rs 11,10,900+1,33,308+40,000 = Rs 12,84,208. So you are paying around 52% in taxes for a car like the Creta.

This is the kind of taxes you are paying for your cars. In the case of the Hyundai Creta, you almost pay 50% on taxes, which is high. But this is not it, you fill in fuel, you pay for maintenance, which also attracts additional taxes.

With this article, I just wanted to create awareness among the people about how much you pay in taxes for their cars.

List of Taxes on Cars You Pay in India

| Segment | GST | Compensation Cess | Total Tax Payable |

| Electric Vehicles | 5% | NIL | 5% |

| Hydrogen Fuel Cell Vehicles | 12% | NIL | 12% |

| Hybrid Passenger Vehicles(up to 4m and up to 1,200cc engine petrol, or up to 1,500cc engine diesel) | 28% | NIL | 28% |

| Passenger Vehicles (petrol, CNG, LPG) up to 4m in length and up to 1,200cc engine | 28% | 1% | 29% |

| Passenger Vehicles (diesel) up to 4m in length and up to 1,500cc engine | 28% | 3% | 31% |

| Hybrid Passenger Vehicles(above 4m or above 1,200 cc engine petrol, or above 1,500 cc engine diesel) | 28% | 15% | 43% |

| Passenger Vehicles (up to 1,500cc engine) | 28% | 17% | 45% |

| Passenger Vehicles (above 1,500cc engine) | 28% | 20% | 48% |

| SUVs (above 4m in length, above 1,500cc engine and above 170 mm ground clearance) | 28% | 22% | 50% |

Maharashtra Road Tax for Cars

| Category | Percentage of Road Tax Applicable (Value/Cost of the vehicle) |

|---|---|

| LPG or CNG vehicles | – |

| Vehicle cost up to ₹10 lakhs | 7% (LPG/CNG), 11% (Petrol), 13% (Diesel) |

| Vehicle costs between ₹10 and ₹20 lakhs | 8% (LPG/CNG), 12% (Petrol), 14% (Diesel) |

| Vehicle cost above ₹20 lakhs | Vehicle costs above ₹20 lakhs |