What is Hindenburg Research? Who gave a report about Adani?

You might have heard about Hindenburg Research in the past week. Hindenburg Research has created many reports in the recent past, but this time they have created a report on Adani on how it has artificially inflated its share price. It also stated that it has a short position on Adani with US-traded bonds. You might have heard a lot about this on the news most of them will be biased either left or right. You would have heard a lot about the case but I won’t be talking about this case, instead, I will tell you about Hindenburg research, and what this company does.

What is Hindenburg Research

Hindenburg Research is a US-based company which was founded in 2017 by Nathan Anderson. It is an investment research firm, and an activist short-selling. The name Hindenburg was kept after the 1937 Hindenburg Disaster, a human-made disaster. Hindenburg was an airship which was fueled by hydrogen. It caught fire and 35 people died. So Nathan Anderson who has a background in Finance and takes this example and says, he started this company to avoid human-made Financial fraud.

Hindenburg is a financial forensic researcher and an activist short seller. They invest months and years’ worth of research behind the target company by scouring its public records and internal trade documents. In addition to this, they also interview former employees and conduct onsite surveys. After this, they generate a report, which they disclose to their investors so that they can have a short position on that company, after that they release this report in public through media and news.

Hindenburg Research Reports

This is not the first time Hinderburg Research has blamed a company and its financial frauds. The most famous case is of Nikola Corporation, a heavy-duty electric vehicle manufacturing company, which was creating fraud and raised $37 Billion. After the report, Nikola’s valuation was at $1.3 billion

List of companies Hindenburg Research created reports on

- Nikola Corporation (NASDAQ: NKLA) – Report released in 2020 (September). Nikola Founder and Executive Chairman Trevor Milton promptly resigned from the company

- WINS Finance (OTCMKTS: WINSF) – Report released in 2020 (June). About four months later, in October 2020, NASDAQ delisted WINS specifically due to the undisclosed asset freeze we identified.

- Genius Brands (NASDAQ: GNUS) – Report released in 2020 (June). By the end of July, just under two months later, shares were trading at $1.50, a decline of almost 80%.

- China Metal Resources Utilization (HKG: 1636) – Report released in 2020 (May). Identified numerous accounting irregularities, including evidence of undisclosed related party transactions. Shares have fallen more than 90%.

- SC Worx (NASDAQ: WORX) – Report Released in 2020 (April). We also raised questions about the CEO, who is a convicted felon, and the track record of the company’s claimed COVID-19 testing partner, which was run by a convicted rapist.

- Predictive Technology Group (OTC: PRED) – Report released in 2020 (March). When we first wrote about the company less than a year earlier, it had a market cap of ~$1 billion. It has since lost ~90% of its value.

- HF Foods (NASDAQ: HFFG) – Report released in 2020 (March). The company had a market cap of just ~$400 million at the time of the reported impairment and loss.

- SmileDirectClub (NASDAQ: SDC) – Report Released in 2019 (Oct). Following our report, exposé was written by the Boston Globe, the New York Times, and NBC News (complete with hidden camera footage and customer testimonials) that supported red flags we originally raised in our report.

- Bloom Energy (NASDAQ: BE) – Report Released in 2019 (Sept). About 5 months after our article, Bloom announced a massive restatement of nearly four years of its financials due to “material” accounting errors relating to its service agreements involving every quarter since it went public.

- Yangtze River Port & Logistics (NASDAQ: YRIV) – Report Released in 2018 (Dec) The company was delisted from NASDAQ 6 months later, lost over 98% of its market cap

- Liberty Health Sciences (LHSIF) – Report Released in 2018 (Dec). Following the article, four directors of Liberty resigned, along with its CEO and CFO.

- Aphria (NYSE: APHA) – Report released in 2018 (Dec & March). Insiders later admitted to having undisclosed stakes in their own acquisitions, leading to the resignation of the company’s Chairman/CEO, a co-founder, and an executive/board shake-up

- Riot Blockchain (NASDAQ: RIOT) – Report Released in 2017 (Dec). Riot’s then-CEO was charged with fraud by the SEC. Its former CEO is reportedly now under active criminal investigation.

- PolarityTE (NASDAQ: PTE) – Report Released in 2017 (Dec). The company’s CFO later resigned and was charged by the SEC in 2018 for allegedly participating in pump & dump schemes.

- Opko Health (NASDAQ: OPK) – Report released in 2017 (Nov). In late 2018 the company’s Chairman/CEO and the company itself were all charged with fraud by the SEC. They later settled the charges.

- Pershing Gold (NASDAQ: PGLC) – Report released in 2017 (Nov). That individual was later charged by the SEC as the “primary strategist” of a group alleged to have run multiple pump-and-dump schemes.

- Clover Health (NASDAQ: CLOV) – Report released in 2021 (Feb)

- Genworth Financials (NYSE: GNW) – Report released in 2018 (Nov)

- RD Legal – RD Legal subsequently lost at trial, leading to a fine and industry suspension of its founder.

When you understand the Hindenburg Research Reports, they mostly target companies with Bad management, Accounting irregularities, Undisclosed third-party transaction, and unethical financial and business reporting practices. This company is targetting companies that are creating financial fraud, it does not target any company in specific, they have targeted, US companies, Chinese companies, and now an Indian company. This doesn’t mean they are doing charity work, but they target these companies by doing hefty research and then before disclosing them to the public, they inform their investors so that they can earn a hefty profit.

In the past companies have faced many difficulties after the Hindenburg report. Like Falling share prices (Nikola, Bloom Energy, and more), regulatory investigation (clover health investments under SEC investigation), and failed acquisitions and deals ( nearly after, 5 years insurance giant Genworth Finacials planned merger with China Oceanwide was cancelled).

In the case of Adani, Hindenburg created this report because of the undisclosed third-party transactions, inflated share price and too much control over the Management. Let’s look at the main allegation by Hindenburg on Adani

What Hindenburg Said about Adani?

Hindenburg created a 418 pages report on Finacial frauds created by Adani. In this report, they state how much Adani has inflated its share price. Hindenburg says the 7 listed companies of Adani have an 85% overvalued share price. The current Shareholding of Adani is as follows. 72.5% of shares are owned by Adani Family members. And out of 27.5%, 15% is held by foreign institutions, LIC owns 4% and only 2% is available for retail investors.

| % of Shares | |

| Adani Group | 72.52% |

| Foreign Institutions | 15.3% |

| Indian Mutual Funds | 1.18% |

| LIC | 4.2% |

| Retail Investors | 2.08% |

| Other | 4.72% |

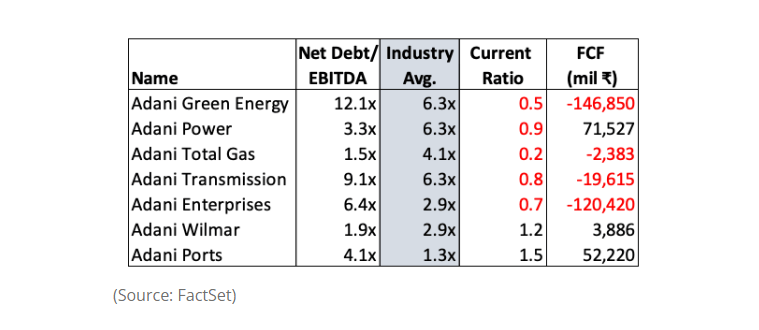

The Current Ratio of 5 out of 7 Adani companies is below 1. When you divide the current assets by the current liability and it is less than 1, this means the company doesn’t have enough money to pay off its debts.

Hindenburg research reports suggest Adani has pledged shares of their inflated stock for loans.

8 of the 22 key leaders are Adani family members

They also claimed Adani has offshore shell entities in tax-haven jurisdictions like Mauritius, the UAE, and Caribbean Islands, to generate artificial turnover. They have also stated that these off-shore companies don’t have a proper online presence, physical address or contact.

Hindenburg also said the audit partners or Adani group have very little experience and are very young.

You can read the complete report here

Conclusion

Hindenburg is a financial forensic researcher, they have done their research and provided this report. Adani should face them and give all the answers, not just answer a few and say the rest of everything is disclosed in the public portal. Because it seems Hindenburg has done their homework. They should not say that is an attack on India, because it is not, it is just an allegation raised over one company Adani. There have been past allegations of the Adani Group of fraud and forgery, but these should be thoroughly checked and regulated by SEBI (Securities and Exchange Board of India).

SEBI should be active if this sort of financial fraud is happening. And as an investor, we need to be alert and understand every company we are investing in. You should not buy or sell Adani shares, because SEBI has not officially said any word on this issue. And the Hindenburg research reports have created a lot of volatility in the market so please invest carefully. The overall market took a hit when the report arrived, but it is now starting to ease off.

Adani is a very big conglomerate, they own large no of companies in various sectors like oil and power, Renewable power, Thermal Power Generation, food processing and infrastructure. I think that is too much power in one company’s hands, government should have a regulation on how much a company can expand so that it doesn’t grow very big and powerful. I hope Adani can tackle this situation as it is a big company, but this report should be a lesson for all the regulators, governments and us consumers, to not make any one or two companies a monopoly or oligopoly.