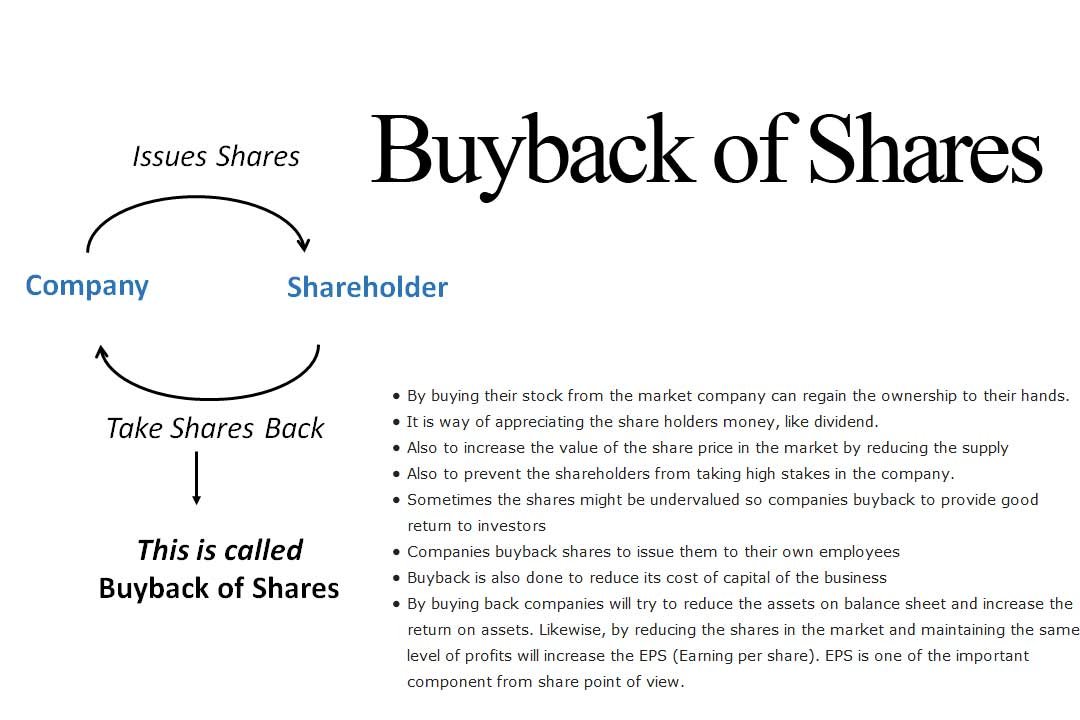

This is one of the terms that might confuse some people. Some people think that buyback is buying the shares at a discounted price after a given time. Buyback of shares is done by company to reduce the number of shares in the market and reduce the cost of capital.

Reason Company buyback the shares

- By buying their stock from the market company can regain the ownership to their hands.

- It is way of appreciating the share holders money, like dividend.

- Also to increase the value of the share price in the market by reducing the supply

- Also to prevent the shareholders from taking high stakes in the company.

- Sometimes the shares might be undervalued so companies buyback to provide good return to investors

- Companies buyback shares to issue them to their own employees

- Buyback is also done to reduce its cost of capital of the business

- By buying back companies will try to reduce the assets on balance sheet and increase the return on assets. Likewise, by reducing the shares in the market and maintaining the same level of profits will increase the EPS (Earning per share). EPS is one of the important component from share point of view.

For example if currently company has 60:40 ratio 60% their capital and 40% capital raised from market. And if they want to have 70:30 ratio company would buy 10% of stocks from the public, this is buyback of shares.

How buyback works

Companies buy the shares from the open market over the period of time and also might use a program that purchases the shares at regular intervals

Companies might offer a tender to the shareholders and ask the shareholder to submit the tender. In this case all or some portion of shares can be sold to the company by an individual in a given time frame. At a premium price to the current market price. This premium price motivates shareholders to sell their share to company.

Second case is mostly used by the company.

Benefits for shareholders

- Shareholders who participate in buyback have a good opportunity of selling their price at a good margin, as companies offer a premium price to market price.

- Buybacks benefit investors by improving shareholder value, increasing share prices, and creating tax beneficial opportunities.

- If a company is buying back its own shares means they have a cash flow in their company which motivates investors and provides a security.

Drawbacks for shareholders

- For shareholders who do not sell their shares, they now have a higher percent of ownership of the company’s shares and a higher price per share. This might look like a benefit but read the bottom point.

- Company can create artificial demand by buyback of shares. Buyback may look like a demand in the stock market which will boost the prices of shares. This would affect the long-term investors, but definitely boost short-term prices.

Read this article when buyback fails.

In short it is good to participate in buyback if you know about the company. Lot of times you invest in a particular company by just seeing short term gains, in that senario you should not go for buyback as you are not aware about the company. So it is always good to know about the company before investing, and if you know about the company you should go for buyback if the offer is good, or else sticking to the ownership is better.