Starting a business is one of the best things you can do to make your life better. No more pushy bosses, no more cause you can’t truly stand behind – you are finally in control of your destiny. Still, as empowering as this idea might be, there is the harsh reality of the fact that before startups start turning a real profit, entrepreneurs have to invest substantial amounts of money to put their dreams into existence. There are initial startup costs, which can be high

Let’s take a look then at some of the ways this major obstacle can be bypassed.

Set a budget and stick to it

Spending on a startup can easily get out of hand. True, small fires can be extinguished with small financial injections. The problem is, these problems stack up quickly and will continue to stack as time goes by. Trying to pay all of them off will bring you financial ruin before you start making money. So, make a budget, allocate the funds necessary to keep the business going and stick to the plan. When problems arise, you will have to try to find a more creative solution to solve them.

Cut the initial startup costs of contracts

No startup can function without a team of talented people behind it. The problem is how you can lure these talented individuals in when you operate on a limited budget. The solution that provides an answer to this problem can come in the form of equity contracts. Namely, instead of paying off employees solely through salaries, you can offer them equity contracts and access to the shared pool. This type of agreement can also tie your employees closer to the goals of your company.

Arrange your offices in a creative manner

Cutting the initial startup costs doesn’t have to come at the expense of efficiency – on the contrary. Throwing out unnecessary furniture pieces and artificial boundaries will make your workspace more open and collaborative. If you need to zone the space in one way or another, you can do that with affordable storage solutions and kill two birds with one stone. Also, you should prioritize the location that will allow your employees affordable commuting and cut the supply costs.

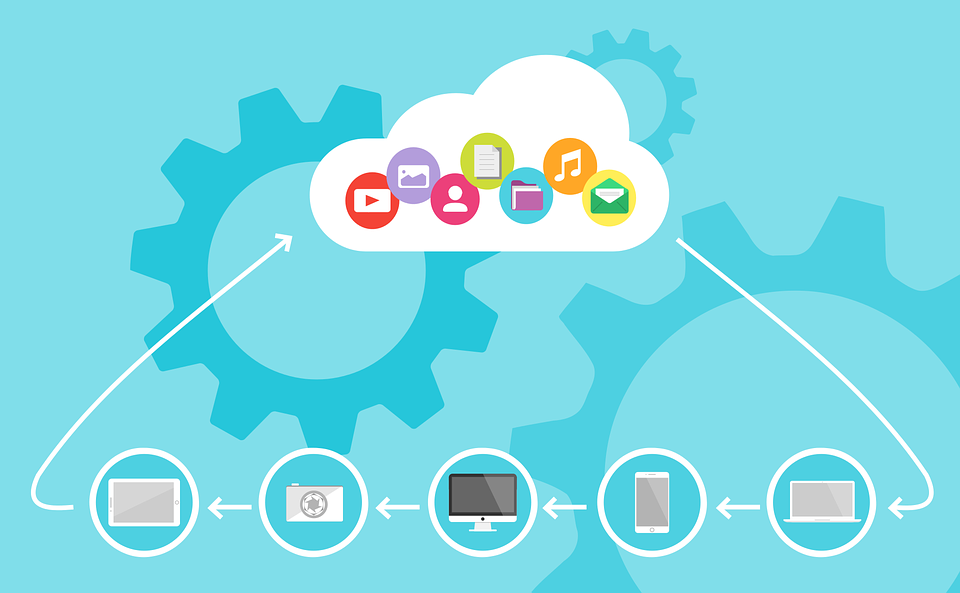

Prioritize Cloud technologies

Cloud technologies are a true blessing for small businesses. First, they can drastically reduce the amount of money you spend on office material. The only things you need to manage your business are capable PCs and a stable internet connection. Second, subscription-based Cloud services are scalable. Once a service becomes superfluous, you can easily cancel the subscription. Finally, Cloud technologies can enable a portion of your employees to work from home, allowing you to rent smaller office space.

Focus on vital products and services

The expansive portfolio of products and services does look very good on paper. However, entering the market with “all guns blazing” can put too much pressure on your already strained budget. Instead, you should identify the demographics that will produce the best response, create a singular efficient product or service that will appeal to that target audience and save all the bells and whistles for the time you start making money.

Resort to inexpensive marketing methods

Initial marketing campaigns can make or break startups. That doesn’t mean that you need to invest too much money into expensive marketing channels. Guerilla marketing always managed to create initial buzz and invoke curiosity even when it was pulled off on a dime. Also, referral programs are incredibly efficient when building an initial customer pool. Finally, there are always reliable social media platforms that allow you to reach a number of prospective clients without substantial investments.

High initial startup costs are one of the major roadblocks preventing a huge number of creative people to find a way out of their 9 to 5 jobs and reinvent themselves as aspiring entrepreneurs. While this problem can’t truly be rooted out, it can be successfully mitigated. We hope these few tips will help you along the way.

2 Replies to “6 ways you can reduce initial startup costs”