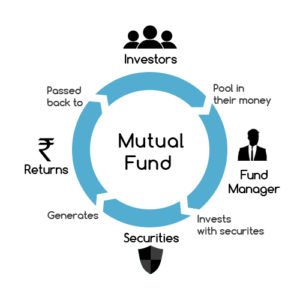

A mutual fund is an investment fund that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt.

It is the ideal investment for the new player who does not know much about investing. It has comparatively low risk compared to the equity market, as your money is diversified. Though it is not an alternative to the Stock market, definitely a good option to invest in. All mutual fund is regulated by SEBI.

The biggest advantage of investing through a mutual fund is that it gives small investors access to professionally managed, diversified portfolios of equities, bonds and other securities, which would be quite difficult to create with a small amount of capital.

Types of Fund

Open-ended Funds (Mutual Fund)

An open-end fund has no limit on the number of shares that can be issued. The fund sponsor sells shares directly to the investor and redeems them as well. The price of the fund varies daily based on the NAV (Net assets value). NAV is reset at the end of the day based on the number of shares bought or sold on that day.

Investors can keep the money in this fund as long as they want. There is no limit on investment. There is no lock-in period, so the investor can liquidate the money whenever they want. They can be purchased or redeemed throughout the year.

Closed-Ended Funds (exchange-traded funds)

On the other hand, these funds can only be bought at IPO and can only be redeemed at the maturity date. The stock price of a closed-end fund fluctuates according to market forces, such as supply and demand. To provide liquidity, these schemes are often listed for trade on a stock exchange. Unlike open-ended mutual funds, once the units or stocks are bought, they cannot be sold back to the mutual fund, instead, they need to be sold through the stock market at the prevailing price of the shares.

Types of Mutual Funds

A mutual fund is categorized into various funds, depending on the size of the investment company, the kinds of securities they have targeted and the amount of return they seek. I have listed below some common types.

Equity Funds

As the same suggests, they invest in diversified stocks. It is similar to an investment in an individual stock and creating your own portfolio. Instead, you are under one fund manager, who is investing in various stocks and manages the entire funds for you. Also, you don’t need a large investment, you can start with a small investment.

Equity funds are named according to the size of the company that funds invest in, small, mid and large-cap. They are categorized through the investment approach, aggressive growth, dividend and others. Also categorized according to the stocks invested in, like domestic or foreign stocks.

Equity funds can be actively or passively managed. Actively managed means the fund manager keeps on shuffling the stocks to outperform the index. Whereas passively managed funds are stuck to the performance of the index. Basically, if the index rises or falls the passive fund will perform the same and the active fund will perform vice versa.

Debt Funds

These kinds of funds invest in fixed-income investments, like Treasury Bills, Government Securities, Corporate Bonds, and Money Market instruments. They have fixed returns with low risk, because of the investment type. It is a low-volatile fund and gives a lower return compared to an equity fund.

Money Market Funds

Money market funds invest in highly liquid instruments such as cash, cash equivalent securities, and high credit rating debt-based securities. These funds are invested for short-term maturity. This makes the fund highly liquid with low risk. Read in detail here.

Balanced Funds

This kind of fund invests in both stocks and bonds to avoid exposure to one specific asset class. It is catering to those investors who are looking for a mixture of safety, income, and small capital appreciation. It is also called an asset allocation fund.

This mixture makes the fund less volatile and less risky. The ratio is generally 60% stock and 40% debt, this varies to 50% or 70% stock and the rest to debt. A balanced fund is a perfect investment fund for investors who are new and are not willing to take high risks, yet want a good return.

Growth Funds

Growth funds concentrate on capital appreciation, rather than dividend payout. These companies reinvest their earnings into the reacquisition and expansion of their business.

This fund has high risk and the investor needs to hold these funds for at least 5-10 years for good returns, they have a high price-to-earnings ratio. High risk and high reward are what define growth funds.

Income Funds

Income funds concentrate on regular returns, unlike growth funds. The income is either a monthly or quarterly payout. These kinds of funds invest in government, corporate debt obligations, preferred stock, money market instruments, and dividend-paying stocks.

Click here and see more types of funds, I have mentioned the most common fund types.

How to Invest in mutual funds

Image: https://www.destinyplannerstt.com/tips/investment-income-mutual-funds/

Investing in a mutual fund is similar to investing in the stock market, you need to have a study of a specific fund thoroughly. You can invest directly by yourself by selecting the best fund after analyzing that fund for some time. Click here and find out the best funds to invest in. By investing on your own you save commission on the fund, it is called a direct fund. And the fund which you invest through a broker is a regular fund.

But if you are new to mutual funds it is advisable to hire a mutual fund advisor. Because they have done the research on their part and will be able to manage your money in a proper way. You can either start with a SIP (Systematic Investment Plan), which is a monthly investment of a fixed amount regularly in a mutual fund scheme, typically an equity mutual fund scheme. A SIP can be weekly, monthly, quarterly, etc.

There are also some funds in which you can put a lump sum amount. It is advised to invest lump sum if you are putting your money for a long term (5+ years). In some funds, you can also get a fixed return monthly. remember mutual funds also fluctuate according to the market. NAV (Net Asset Value) changes according to the asset prices inside that MF.

Common Approaches to Investing

Top-down approach: Look at the economy and see which industry is doing good. Then select the companies inside those industries and invest.

Bottom-up approach: Focus on the specific company and study that company and see whether it is doing well regardless of the industry.

Technical analysis: Try to analyze and forecast the performance of the company or industry by studying past market data.

Fundamental analysis: Studying complete in-depth detail about the company. The price-to-earnings ratio, balance sheet, interest rates, and economic condition (domestic and global). Basically knowing the stock’s intrinsic value. If the measured price is above the current trading price, you should sell the stock and vice versa.

Advantages of Mutual fund

- Liquidity

- Diversification

- Minimal investment requirements

- Professional management

- Variety of offerings

- Tax Benefit funds

- Safety

Disadvantages of Mutual Funds

- Cost to manage the fund

- Lock-in Periods

- Dilution

Visit Moneycontrol and pick your best MF for investment. I have shared the knowledge I had about Mutual funds, I will learn more as I am investing in Mutual Funds.

One Reply to “What is Mutual Fund and its types and how to invest”