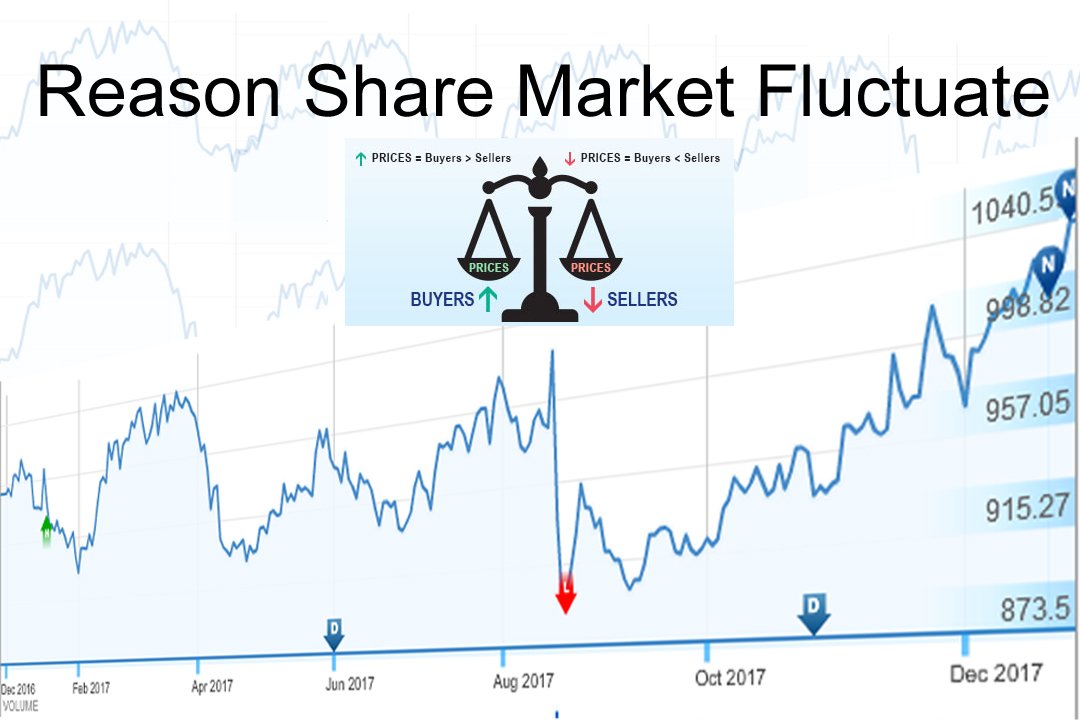

We all know Share market fluctuates very frequently, even if the person is not trading still knows the price varies. It is caused by demand and supply, if the people are buying more of that stock the price will rise, or people are selling more of that stock the price will fall. But why do people buy or sell any stock, what makes you buy any stock in the first place.

We buy stocks as an investment through which we can earn a profit. Buying and selling shares can make you a quick profit if the decision was made at the right time. We also get a dividend for holding on to the shares for a period of time. And we are the investors in the company so technically we are a part-owner of the company. Click here to learn how to invest and here for some tips.

Though demand and supply change the prices, sometimes we see a drastic change in the market which are not caused by demand and supply. And this question arises to almost all the investors. So I will list out some of the forces that cause this fluctuation.

After reading this post you will come to know how the prices are changed and set in the share market. Keep in mind that the price of BSE and NSE may be down but not necessarily all the companies listed inside them will fall or vice versa.

Reasons Share market Fluctuate

First, understand how the trading of stocks takes place. The primary market is the market where new stocks and bonds are floated. You can see this market where an IPO (initial public offering) takes place. The secondary market is where the investors buy or sell the stocks at an auctioned price, you can see this auction. Investors include individuals, corporations, institutions, governments.

The other difference between primary and secondary is, You can also buy shares directly from the issuing company in the primary market. And in secondary market shares are bought between investors.

The investors on the secondary market are willing to buy the stocks which are sold from the primary market. Then the auction takes place and the buyers and sellers agree upon a price and that price becomes the new market quotation.

List of Factors affecting Share Market

- When the sellers outnumber the buyers the price of the share falls.

- If a company is liquidated who is listed on NSE or BSE, it will affect the share price of that company and also related companies. For Eg If a coal manufacturing company is liquidated, the business of the companies who bought coal from that company will also affect, and this will affect the market price of that company.

- We see changes in the board of directors of the company, it will affect the market price of the companies share. For Eg, The CEO of Infosys resigned and the share price of Infosys took a downturn.

- If there is a change in government policies, the Share price of all the companies which are affected by the policy will fluctuate. For Eg When the government introduced demonetization and GST, NSE and BSE took a downturn.

- If the business is uncertain, the share price will fall because people will not prefer to buy that share.

- Using moneycontrol you can see any companies market price from the date of listing. Click here to see Infosys market price.

These are a few factors that I have faced myself while trading in the equity market. Sure there are other market forces that affect the share price. Feel free to comment any more further factors that you think might affect the market, or join me and write more about this topic or any other topic. Finally just one think while trading in share market you have to be very careful and should have a detailed understanding of everything happens around you to earn really good profit.