What is Payment Gateways and how it works 2021

Hello, guys payment gateways are an important factor in a website where there is a money transaction. Today I will list out some of the best and most used payment gateways in India.

What is the Payment Gateway?

A payment gateway is a service that authorizes a payment using credit cards, debit cards, Net banking, UPI, etc. This kind of service is used where online transaction is taking place. It includes online business, e-commerce, etc. If you want to sell anything online using a website, your website must have a payment gateway integrated.

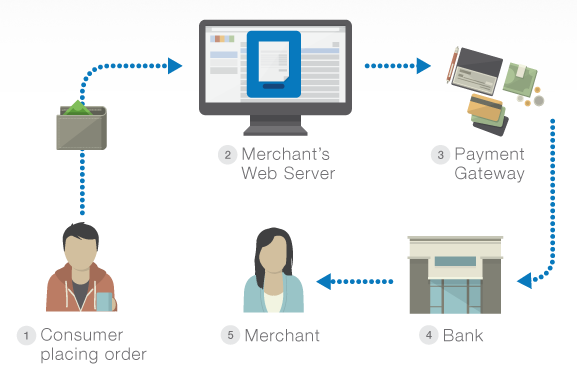

Working of Payment gateway

The payment gateway acts as a middleman between the bank and the merchant’s website. When you(user) wishes to make a payment, the website sends encrypted payment details through the payment gateway. The payment gateway confirms the validity of these payment details with the respected bank and dispatches the amount request by the user(you) from your account to the merchant’s account.

Look for these points before using any payment gateway

- Security & Trust

- Reliability

- Good Rates

- Diversity

- Superior User Experience

- Easy Integration

- Multiple Payment Options (Credit/Debit Cards, Net-Banking, Mobile Wallets, etc)

Some of the Best Payment Gateway in 2022 in India

Open Money

The Payment Gateway from OPEN (Asia’s first neobanking platform) is one of the most robust and affordable options available in India. It is well-known within the industry for its versatility, ease of use, and security.

Open’s Payment Gateway enables SMEs, Startups, and Freelancers to have the flexibility to choose from over 200 payment collection methods. The Payment Gateway is easy to integrate, reliable and provides real-time settlements.

So what exactly sets Open’s Payment Gateway apart from others?

With OPEN’s Dashboard, users can:

- Leverage SDKs for both Android and iOS for mobile applications

- Get the custom checkout page to match the look and feel of their website or app

- Easily place the Payment Button on their website or app

- Integrate Open’s MarketPlace API and settle payments directly into multiple accounts

- Create and send GST-compliant invoices with built-in payment links.

That’s not all! OPEN’s dashboard has several other features that simplify the financial management of your business. Some of them are :

- Current Account with VISA Business Card

- Virtual and Expense Cards with built-in Expense Management

- Tax Management with fast GST and TDS payment capabilities

Settlement: Instant

Charges :

- 1.85% domestic credit/debit cards, Net banking

- NIL for UPI and Rupay debit cards

Head over to Open and integrate all your payments, banking, accounting & expense management – all in One online bank account.

PayKun

PayKun is one of the top payment gateways in India. You can accept online payments with the PayKun payment gateway by integrating it with the website or mobile application, you may even add its payment button on the website or using its payment links. Thus, a website or app is not compulsory.

It charges the lowest per-transaction rates (TDR) in India of flat 1.75%. There are no other charges such as set up fees, maintenance fees, or integration charges.

It provides the settlement cycle of t+1/2/3 working days. To activate the PayKun merchant account, you need to go through an easy registration process. Sign up with basic details and documents and activate the merchant account in no time.

It provides 120+ payment method options including debit cards. credit cards, net banking, wallets, UPI, EMI, and QR code and supports multiple currencies.

Visit here to know more about the PayKun payment gateway.

Razorpay

It is one of the best payment gateways in India. It was founded by IIT Roorkee alumni in 2013. Razorpay targets Startups and small business.

- They provide a checkout page, which means you don’t need a website to accept payments, you can create a custom page with your brand on their website.

- Razorpay also have payment links, simply send those link to the person you want to receive payment from and that person will pay using net banking, credit or debit card or UPI using that link

- They also have a payment button than can be easily placed on your website or app.

- They have much more features please visit their site to know more

Charges

- They accept 100 major currencies

- Razorpay uses tokenisation to prevent data exposure

- They charge 2.00% of all the transaction amount, but they are providing offers to the new account by not taking any transaction fee for 3 months or up to Rs 3,00,000

- Razorpay uses the highest assured SSL/TLS which makes sure no unauthorized person can access your data.

Instamojo

Instamojo is one of the best payment gateways in India. It was started by Aditya Sengupta, Akash Gehani, Harshad Sharma and Sampad Swain in 2012. Instamojo can host your file or content and provide Buy Now button to that file or content, in short, you don’t need any website to host your content. No redirection required, customers will not even have to redirect to a different page to do the payment.

Instamojo charges 1.9% of the successful transactions. If you want to host your content on their website, they will charge 5% of the transaction. Instamojo will collect the money on your behalf and send the amount to your bank account within 3 business days. For example, if you price a song at Rs. 100 and sell it through Instamojo, you will get Rs. 97.83 in your bank account. InstaMojo will deduct Rs. 1.9 as their fee and Rs. 0.27 as service tax.

Visit their site here.

CCAvenue

CCavenue is one of the biggest gateways in India. Almost 80% of e-commerce merchants use this service. CCavenue also helps you accept international payment. They allow you to accept payment in 27 major currencies (including USD, GBP, Euro, Yen, Yuan, etc.).

It also provides a multilingual checkout page. This is really helpful for those people who do not understand English. CCAvenue allows the customer to see the check-out page in the language that they understand the best. They offer an interface in 18 major Indian and International languages.

CCAvenue has no setup fee, they charge yearly maintenance of Rs1200 which is waived off for the first year. They charge 2% on all domestic credit and debit cards, net banking and UPI. For international credit and debit cars 3%. They have 27 Multi-currency options for which they charge 4.99%.

They offer a large number of payment options:

- 14+ Credit Card EMI options SBI / ICICI / HDFC / Axis / Kotak / IndusInd / HSBC/ Central Bank of India / Standard Chartered Bank/ Corporation Bank / Ratnakar bank / YES Bank / IDBI Bank/ Bank of Baroda

- 100+ Debit Cards (Domestic) (All MasterCard / Visa / Maestro / RuPay)

- 58+ Net Banking

- 10+ Prepaid Cards / Wallets Paytm / MobiKwik / JioMoney / PayZapp /Freecharge / The Mobile Wallet / ITZCash / ICash / Oxicash / PayCash

- UPI Payments

International Payments

- MasterCard & Visa Credit / Debit Cards (International) 3.00%

- Corporate / Commercial Credit Cards (Domestic) 3.00%

- American Express / Amex EMI & Diners Club 4.00%

- 27 Multi-currency options 4.99%

Visit their site here to know more about this payment gateway

PayPal

It was found by Elon Musk, Peter Thiel, Max Levchin, Luke Nosek, Ken Howery, Yu Pan in Dec 1998. It is one of the oldest payment gateways. When it was started it was a revolutionary idea of sending money using email. It is a simple and inexpensive way of sending and getting money.

It is easy to start off with. First, register with PayPal using an email address. Then link that PayPal account to your bank account by using bank account no, bank name and IFSC code of your bank branch. After this PayPal will transfer two small amounts (Rs.1 and Rs.2) to your account. After receiving these amounts you need to go to your PayPal profile and enter the amount received. If entered the correct values your PayPal account is now ready for transactions.

To receive payments just give your PayPal registered email id to the person you want to receive payments from. After the person sends the payment you will receive an email about the transaction.

In some countries, they will let you keep money in the Paypal account but in India, you cannot. So when you receive payment in a PayPal account it will automatically be transferred to your linked bank account after cutting the PayPal commission (3.4% of total transaction). Same procedure for sending payments.

So head to the site and start sending and receiving payments.

There are numerous payment gateways in 2022 you can use.

I have not included other payment options as there will be a big post if I mentioned all the payment options. The most used and secure payment options are explained by me and the other few I have listed out.

best payment gateway content it shows about all over on the payment gateway

Thank You

Pingback: 5 Digital Payment Trends in 2019 – ReviewStories